UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Schedule 14A

(RULE 14A-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a party other than the Registrant ¨

Check the appropriate box:

| ¨ |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549 |

|

SCHEDULE 14A

(RULE 14a-101)

|

|

SCHEDULE 14A INFORMATION

|

|

Preliminary Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. ) |

|

Filed by the Registrant [ X ]

Filed by a Party other than the Registrant [ ] |

| | |

| ¨ | | |

Check the appropriate box:

| | |

| | |

[ ] | Preliminary proxy statement | | |

| | | |

[ ] | Confidential, for useUse of the Commission only | | |

| (asOnly (as permitted by Rule 14a-6(e)(2)) | | |

| | | |

[X]x | Definitive proxy statement | | Proxy Statement |

| | | |

[ ]¨ | Definitive Additional Materials | | |

| | | |

[ ]¨ | Soliciting Material Pursuant to § 240.14a-12 | | |

CHINA YOUTH MEDIA, INC.

(Name of Registrant as Specified in Its Charter)MIDWEST ENERGY EMISSIONS CORP.

|

(Exact name of registrant as specified in its charter) |

Commission file number 000-33067

Payment of Filing Fee (Check the appropriate box):

____________________________________

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

|

Payment of filing fee (Check the appropriate box): |

|

[X] | x | No fee required. |

|

[ ] | ¨ | Fee computed on the table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

| (1) | Title of each class of securities to which transaction applies: |

| N/A(2) | |

| (2) | Aggregate number of securities to which transaction applies: |

| N/A(3) | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11:0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| N/A(4) | |

| (4) | Proposed maximum aggregate value of transaction: |

| N/A¨ | |

| | | | |

[ ] | Fee paid previously with preliminary materials.materials: |

| ¨ | | | |

[ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | | | |

| (1) | Amount previously paid:Not Applicable |

| N/A(2) | Form, Schedule or Registration Statement No.: |

| (2) | Form, schedule or registration statement no.: | N/A | |

| (3) | Not Applicable |

| (3) | Filing party: | N/A | Party: |

| (4) | Date filed: |

| N/A | Not Applicable |

CHINA YOUTH MEDIA, INC.

4143 Glencoe Avenue

Marina Del Rey, California 90292

| (4) | Date Filed: |

| | |

| | Not Applicable |

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

MIDWEST ENERGY EMISSIONS CORP.

500 W. Wilson Bridge Rd, Suite 140

Worthington, Ohio 43085

____________

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

SHAREHOLDERS

TO BE HELD ON JUNE 19, 2009NOVEMBER 18, 2014

To the Stockholders:

PLEASE TAKE NOTICE____________

TO THE SHAREHOLDERS:

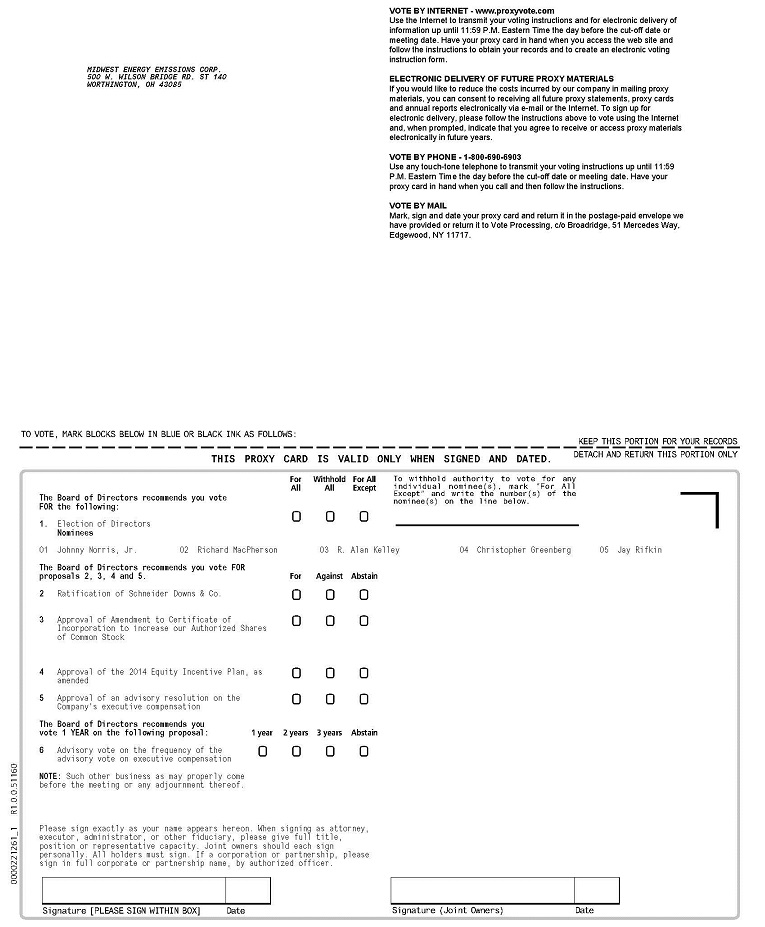

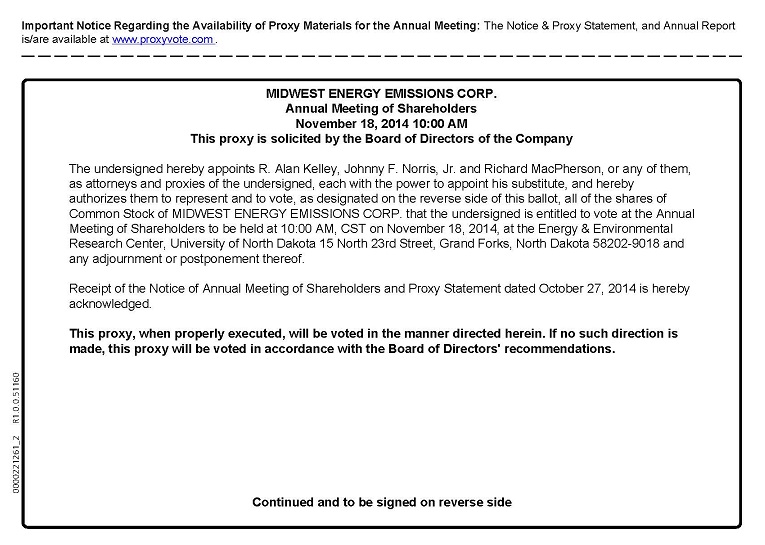

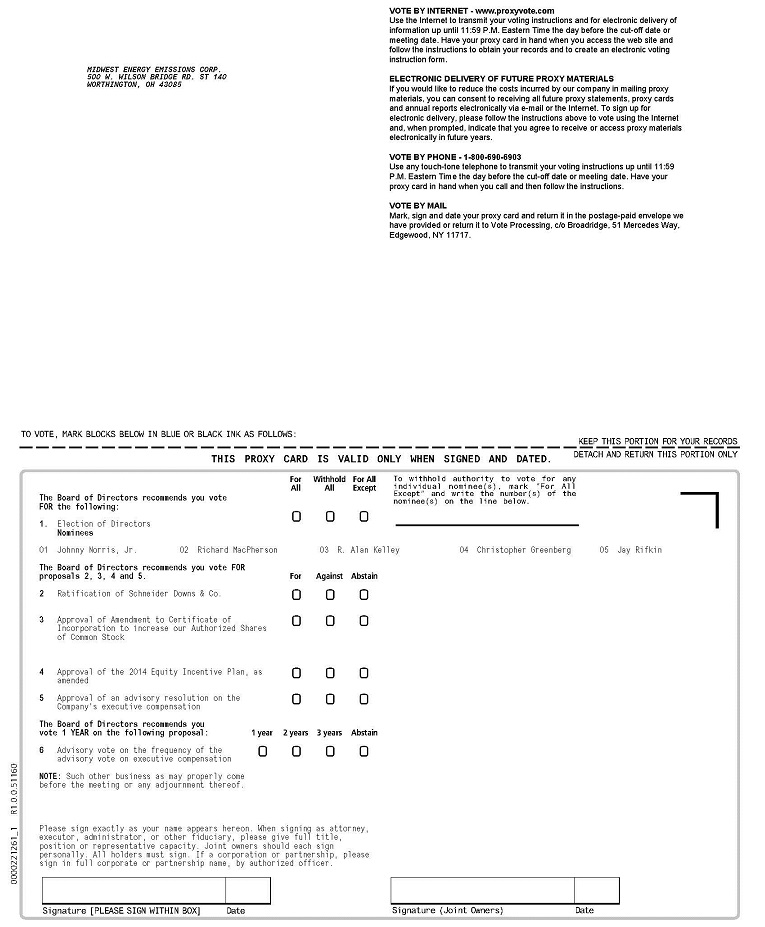

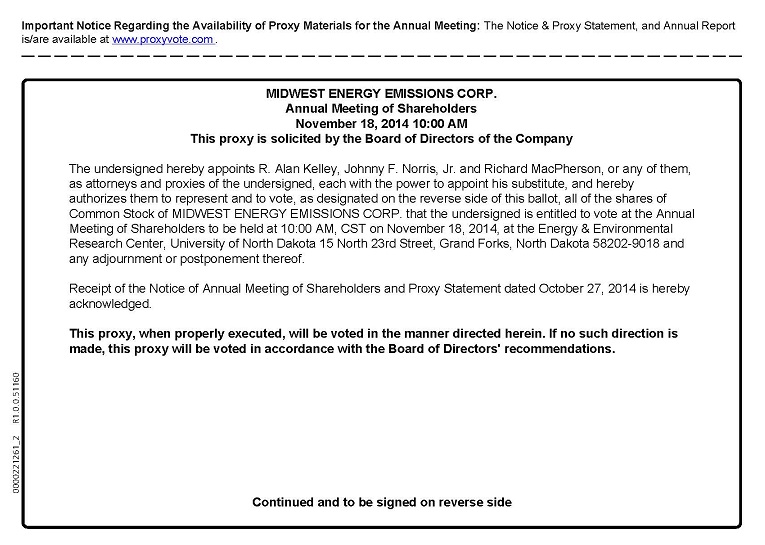

You are hereby notified that the Annual Meeting of Stockholders (the “Annual Meeting”)Shareholders of China Youth Media, Inc.Midwest Energy Emissions Corp., a Delaware corporation (the “Company”), will be held at the Energy & Environmental Research Center, 15 N. 23rd St., Grand Forks, North Dakota 58202, on June 19, 2009,Tuesday, November 18, 2014, at 2:10:00 p.m.a.m., local time, at Holiday Inn – At the Pier, 120 Colorado Avenue, Santa Monica, California 90401,Central Time, for the following purposes:

| | 1. | To electElection of five Directors to serve as the Boarddirectors, each for a term of Directors of the Company until the next Annual Meeting of Stockholders and until their successors shall be elected and shall qualify;one year. |

| | |

| 2. | Ratification of the appointment of Schneider Downs & Co., Inc. |

| | 2. | To amend the Company's Stock Option and Restricted Stock Plan (the “Stock Plan”); | |

| 3. | Proposal to approve the Amendment to Certificate of Incorporation to increase our authorized shares of Common Stock by 50,000,000. |

| | 3. | To ratify the appointment of Tarvaran Askelson & Company, LLP as the Company's independent registered public accountants for the year ending December 31, 2009; and | |

| 6. | An advisory vote on the frequency of holding an advisory vote to approve executive compensation. |

| | 4. | |

| 7. | To transact such other business as may properly come before the Annual Meetingmeeting or any adjournment thereof. |

Only shareholders of record at the close of business on October 17, 2014 will be entitled to notice of, and to vote at, the meeting or any adjournment thereof.

| BY ORDER OF THE BOARD OF DIRECTORS, |

| | |

The close of business on May 14, 2009 has been fixed as the record date for determining stockholders entitled to receive notice of and to vote at the Annual Meeting and at any adjournment thereof. |

October 27, 2014 | | |

Your attention is called to the proxy statement on the following pages. We hope that you will attend the Annual Meeting. If you do not plan to attend, please sign, date and mail the enclosed proxy card in the enclosed envelope, which requires no postage if mailed in the United States.RICHARD H. GROSS Secretary |

| | | By Order of the Board of Directors, | |

| | | | |

| | | Jay Rifkin, | |

| | | President and Chief Executive Officer | |

| Marina Del Rey, California | | | |

| May 29, 2009 | | | |

***

IMPORTANT NOTICE***

Regarding Internet Availability of Proxy Materials

for the Annual Meeting to be held on June 19, 2009.

The Proxy Statement, Form of Proxy and Annual Report to security holders are available at

www.chinayouthmedia.com/en/investor-relations

CHINA YOUTH MEDIA, INC.

NOTICE REGARDING THE AVAILABILITY OF PROXY STATEMENT

MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS

SHAREHOLDERS TO BE HELD ON JUNE 19, 2009

_____________________________

INTRODUCTIONNOVEMBER 18, 2014:

This Proxy Statementproxy statement and the Company’s 2013 annual report to shareholders are also available at http://www.midwestemissions.com/meeting-access/

SHAREHOLDERS WHO DO NOT EXPECT TO ATTEND THE ANNUAL MEETING IN PERSON ARE URGED TO VOTE BY TELEPHONE OR THE INTERNET OR TO COMPLETE, DATE AND SIGN THE ENCLOSED PROXY AND RETURN IT IN THE ENCLOSED POSTAGE-PAID ENVELOPE TO ENSURE THAT THEIR SHARES ARE REPRESENTED AT THE ANNUAL MEETING OR ANY ADJOURNMENT THEREOF.

MIDWEST ENERGY EMISSIONS CORP

500 W. Wilson Bridge Rd, Suite 140

Worthington, Ohio 43085

____________________

PROXY STATEMENT

____________________

This proxy statement is being furnished to stockholders of China Youth Media, Inc., a Delaware corporation (the “Company”), in connection with the solicitation of proxies by and on behalf of the Board of Directors of Midwest Energy Emissions Corp., a Delaware corporation (the “Company”), for use at the Annual Meeting of Shareholders of the Company (the “Board of Directors”“Annual Meeting”) for use at an Annual Meeting of Stockholders of the Company to be held at the Energy & Environmental Research Center, 15 N. 23rd St., Grand Forks, North Dakota 58202, on June 19, 2009,Tuesday, November 18, 2014, at 2:10:00 p.m.a.m., local time, at Holiday Inn – At the Pier, 120 Colorado Avenue, Santa Monica, California 90401,Central Time, and at any adjournment thereof (the “Annual Meeting”).thereof.

The Board has fixed

This proxy statement and accompanying notice and form of proxy are being mailed to shareholders on or about October 27, 2014. A copy of the close of business on May 14, 2009 as the record dateCompany’s Annual Report to Shareholders, including financial statements, for the determinationfiscal year December 31, 2013 (the “2013 fiscal year”) is enclosed with this proxy statement.

The presence of stockholders entitled to receive notice of, and voteany shareholder at the Annual Meeting (the “Record Date”). Accordingly, only stockholders of record on the books of the Company at the close of business on the Record Date will be entitled to vote at the Annual Meeting. On the Record Date, the Company had outstanding approximately 157,346,672 shares of Common Stock, par value $0.001 per share (the “Common Stock”) which are the only outstanding voting securities of the Company. On all matters, each share of Common Stock is entitled to one vote.

The cost of soliciting proxies will be borne by the Company. In addition to solicitation by mail, officers, directors and other employees of the Company may solicit proxies by personal contact, telephone, facsimile or other electronic means without additional compensation. This Proxy Statement and the accompanying proxy card are first being mailed to stockholders on or about May 29, 2009.

Proxies in the accompanying form which are properly executed, duly returned and not revoked, will be voted in accordance with the instructions thereon. If no instructions are indicated thereon, proxies will be voted FOR all matters listed in the Notice of Annual Meeting of Stockholders and in accordance with the discretion of the person(s) voting the proxies with respect to all other matters properly presented at the Annual Meeting. Execution of a proxy will not prevent a stockholder from attending the Annual Meeting and voting in person.operate to revoke his proxy. Any stockholder giving a proxy may revoke itbe revoked, at any time before it is votedexercised, in open meeting, or by deliveringgiving notice to the Secretary of the Company written notice of revocationin writing, or by filing a duly executed proxy bearing a later date than the proxy, by delivering a later-dated proxy, or by voting in person at the Annual Meeting. Attendance at the Annual Meeting will not, in anddate.

The holders of itself, constitute revoca tion of a proxy. The holdersshares of a majority of the shares of Common Stockcommon stock outstanding and entitled to vote as ofon the Record Date,record date, present in person or represented by proxy, shall constitute a quorum for the transaction of business to be considered at the Annual Meeting. A pluralityBroker non-votes and abstaining votes will be counted as “present” for purposes of determining whether a quorum has been achieved at the meeting, but will not be counted in favor of or against any director nominee. The voting standards for each of the other known matters to be considered at the meeting are set forth within the proposals.

If the enclosed proxy is executed and returned to the Company, the persons named therein will vote the shares represented by it at the Annual Meeting. The proxy permits specification of a vote for the election of directors, or the withholding of authority to vote in the election of directors, or the withholding of authority to vote for one or more specified nominees and a vote for, against or abstain on the other proposals described in this proxy statement. Where a choice is specified in the proxy, the shares of common stock represented thereby will be voted in accordance with such specification. If no specification is made, such shares will be voted to elect as directors the nominees set forth herein under “Election of Directors” and FOR the other proposals (for one year on the say-on-pay frequency proposal) included in this proxy.

The close of business on October 17, 2014 has been fixed as the record date for the determination of shareholders entitled to notice of and to vote at the Annual Meeting. As of October 17, 2014, the Company’s outstanding voting securities consisted of 40,228,123 shares of common stock, with par value of $0.001, each of which is entitled to one vote on all matters to be presented to the shareholders at the Annual Meeting.

VOTING PROCEDURES

If you are a record holder:

| · | You may vote by mail: complete and sign your proxy card and mail it in the enclosed, prepaid and addressed envelope. |

| · | You may vote by telephone: call toll-free 1-800-690-6903 on a touch tone phone and follow the instructions provide by the recorded message. You will need your proxy card available if you vote by telephone. |

| · | You may vote by Internet: access www.proxyvote.com and follow the steps outlined on the secure website. |

| · | You may vote in person at the meeting, however, you are encouraged to vote by mail, telephone or Internet even if you plan to attend the meeting. |

If you are a “street name” holder:

| · | You must vote your shares of common stock through the procedures established by your bank, broker, or other holder of record. Your bank, broker, or other holder of record has enclosed or otherwise provided a voting instruction card for you to use in directing the bank, broker, or other holder of record how to vote your shares of common stock. |

| · | You may vote at the meeting, however, to do so, you will first need to ask your bank, broker or other holder of record to furnish you with a legal proxy. You will need to bring the legal proxy with you to the meeting and hand it in with a signed ballot that you can request at the meeting. You will not be able to vote your shares of common stock at the meeting without a legal proxy and signed ballot. |

ANNUAL REPORT; INTERNET AVAILABILITY

A copy of our Annual Report to Shareholders for the year ended December 31, 2013 is enclosed with this Proxy Statement. Additional, this proxy Statement and our Annual Report to Shareholders for the year ended December 31, 2013 are available at http://www.midwestemissions.com/meeting-access/.

PROPOSAL 1: ELECTION OF DIRECTORS

At the Annual Meeting, shares represented by proxies will be voted, unless otherwise specified in such proxies, for the election of the five nominees to the Board of Directors named in this proxy statement and the enclosed proxy. These nominees were selected by the Board of Directors and will, if elected, serve as directors of the Company until the next Annual Meeting of the shareholders and until their successors are elected and qualified or until their earlier removal or resignation. All of the nominees are currently members of the Board of Directors and all nominees have consented to be nominated and to serve if elected. If, for any reason, any one or more nominees become unavailable for election, it is expected that proxies will be voted for the election of such substitute nominees as may be designated by the Board of Directors. The director nominees who receive the greatest number of affirmative votes castwill be elected.

Nominees to serve for the One-Year Term expiring in 2015:

Name | | Age | | Principal Occupation for the Past Five Years | | Director of the Company Since | |

Johnny F. Norris, Jr. | | 65 | | Chief Executive Officer (2011 to 2013); President and Chief Executive Officer, Fuel Tech, Inc. (air pollution control company) (2006 to 2010) | | 2011 | |

Richard A. MacPherson | | 59 | | Director of Business Development, (2011 to present) Chief Executive Officer, MES, Inc. (current subsidiary and operating company of the Company) (2008 to 2011) | | 2011 | |

Jay Rifkin | | 59 | | President, Mojo Music, Inc. (1995 to present); Chief Executive Officer (2005 to 2011) | | 2006 | |

R. Alan Kelley | | 62 | | President and Chief Executive Officer (June 2013 to present); President and Chief Operating Officer (November 2011 to June 2013); President and Chief Executive Officer, Grand Bahama Power Company (2009 to 2011) | | 2013 | |

Christopher Greenberg | | 48 | | Chief Executive Officer, Global Safety Network (employment screening and safety compliance services) (2003 to present); Owner, Express Employment Professionals (staffing agency that provides full time and temporary job placement, human resources services and consulting) (1997 to present) | | 2013 | |

The Board of Directors recommends that the Shareholders vote FOR the nominees.

In addition to the professional and occupational experience described above for each nominee, the Board has concluded that the skills, qualifications, experiences and attributes described below make the nominees persons who should serve as directors:

Johnny F. Norris, Jr. – Mr. Norris has decades of demonstrated experience at the senior executive level. He has an industry-proven ability in successfully building new services companies. Mr. Norris has many years of significant public company experience, and has been instrumental in managing over a dozen successful mergers and acquisitions in his career. His experience includes both COO and CEO positions at mid-size companies, as well as senior executive positions in major corporations with direct operational responsibility of tens of billions of dollars in assets, billions of dollars in annual revenues, and over 8,000 employees.

Richard A. MacPherson – Mr. MacPherson has worked with industry leading scientists and engineers to bring the Company’s technology from the R&D phase, through multiple product development stages, to the final commercialization phase, acting as the lead on all required initiatives and activities.

Jay Rifkin – Mr. Rifkin is a successful media executive who founded Mojo Music, Inc., a music publishing company, in 1995 and has been President since it was founded. Mr. Rifkin has served as Producer and Executive Producer on various motion pictures and is also a music producer, engineer and songwriter. From 1988 to 2004, Mr. Rifkin, through Mojo Music, Inc., served as a Managing Member of Media Ventures, LLC, an entertainment cooperative founded by Mr. Rifkin and composer Hans Zimmer. In 1995 Mr. Rifkin founded Mojo Records, LLC, which in 1996 became a joint venture with Universal Records, and was subsequently sold to Zomba/BMG Records in 2001.

R. Alan Kelley – Mr. Kelley has many years of extensive public company experience as well as demonstrated success in multiple “turnarounds” of underperforming businesses. In addition, Mr. Kelley has international experience in developing and implementing return-on-investment regulatory structures. Mr. Kelley was Chairman of the Association of Edison Illuminating Companies Generation Committee, whose members represent over half of the generating facilities nationally and Chairman of the Mid-America Interconnected Network Regional Reliability Council. He is a former member of the Board of Directors of the North American Electric Reliability Council.

Christopher Greenberg – Mr. Greenberg is a dedicated and technically-skilled business professional with a versatile skill set developed through experience as an entrepreneur, business developer and community leader. Currently Mr. Greenberg is the CEO of Global Safety Network and owner of Express Employment Professionals (Grand Forks, Fargo, Minot, North Dakota, Aberdeen and Watertown, South Dakota and Tampa, Florida). A highly-experienced Operations Executive who has demonstrated the ability to lead diverse teams of professionals to new levels of success in a variety of highly-competitive industries, cutting-edge markets, and fast-paced environments. Mr. Greenberg has strong technical and business qualifications with an impressive track record of more than 19 years of hands-on experience in strategic planning, business unit development, project and product management, and proprietary software development. He also has the proven ability to successfully analyze an organization’s critical business requirements, identify deficiencies and potential opportunities, and develop innovative and cost-effective solutions for enhancing competitiveness, increasing revenues, and improving customer service offerings.

Board Leadership

The Board does not have a formal policy regarding the separation of the roles of CEO and Chairman of the Board as the Board believes it is in the best interest of the Company and our shareholders to make that determination based on the position and direction of the Company and the membership of the Board. At this time, the Board has determined that separating the role of Chairman from the role of CEO is in the best interest of the Company and our shareholders. This structure permits our President and CEO to devote more time to focus on the strategic direction and management of our day-to-day operations. Currently the Board has one independent director, Mr. Greenberg.

Board’s Role in Risk Oversight

It is management’s responsibility to manage risk and bring to the Board of Directors’ attention the most material risks to the Company. The Board of Directors has oversight responsibility of the processes established to report and monitor systems for material risks applicable to the Company. The full Board regularly reviews enterprise-wide risk management, which includes treasury risks, financial and accounting risks, legal and compliance risks and other risk management functions. The full Board considers risks related to the attraction and retention of talent and related to the design of compensation programs tailored to the specific needs of the Company. The full Board considers strategic risks and opportunities and receives reports from management on risk.

Board of Directors Structure

The Board of Directors has determined that Christopher Greenberg is an “independent director” as defined by the listing standards of The NASDAQ Stock Market.

The full Board of Directors acts as an Audit Committee and a Compensation Committee. In addition, the Company’s Board of Directors does not have a Nominating Committee. The Board of Directors as a whole functions as the Nominating Committee due to the relatively small size of the Board and the smaller market capitalization of the Company. Therefore, the Board does not have any committee charters.

The full Board of Directors acts as the Audit Committee and approves the Company’s retention of independent auditors and pre-approves any audit or non-audit services performed by them. It reviews with such accountants the arrangements for, and the scope of, the audit to be conducted by them. It also reviews with the independent accountants and with management the results of audits and various other financial and accounting matters affecting the Company.

The Board of Directors acts as the Compensation Committee and administers the Company’s compensation, benefits and the Company’s 2014 Equity Incentive Plan. Our policies and overall compensation practices for all employees do not create risks that are reasonably likely to have a material adverse effect on the Company. In addition, incentive compensation (in the past generally in the form of stock options) is not designed to create, and does not create, risks that are reasonably likely to have a material adverse effect on the Company. Recommendations regarding compensation of officers (other than the CEO) are made to the full Board by our CEO. The Board of Directors can exercise its discretion in modifying any amount presented by our CEO. During fiscal 2013 the Board of Directors did not retain the services of a compensation consultant.

The Board of Directors met 14 times during the 2013. Each director currently serving on the Board attended 75% or more of the meetings held during such year by the Board. The Company encourages the attendance of all directors at the Company’s annual meeting of shareholders.

Nominations for Director are made by the Board of Directors as a whole. The Board determines the desired skills and characteristics for directors as well as the composition of the Board of Directors as a whole. This assessment considers the directors’ qualifications and independence, as well as diversity, age, skill and experience in the context of the needs of the Board of Directors. At a minimum, directors should share the values of the Company and should possess the following characteristics: high personal and professional integrity; the ability to exercise sound business judgment; an inquiring mind; and the time available to devote to Board of Directors’ activities and the willingness to do so. The Board does not have a formal policy specifically focusing on the consideration of diversity; however, diversity is one of the many factors that the Board considers when identifying candidates. In addition to the foregoing considerations, generally with respect to nominees recommended by shareholders, the Board will evaluate such recommended nominees considering the additional information regarding the nominees provided to the Board. When seeking candidates for the Board of Directors, the Board may solicit suggestions from incumbent directors, management and third-party search firms. Ultimately, the Board will recommend prospective nominees who the Board believes will be effective, in conjunction with the other members of the Board of Directors, in collectively serving the long-term interests of the Company’s shareholders. The Board will review any candidate recommended by shareholders of the Company in light of its criteria for selection of new directors. See “2015 Stockholder Proposals or Nominations.”

PROPOSAL 2: RATIFICATION OF THE APPOINTMENT OF SCHNEIDER DOWNS & CO., INC.

The full Board of Directors act as the Audit Committee. The Board currently anticipates appointing Schneider Downs & Co., Inc. as our independent registered public accounting firm for the fiscal year ending December 31, 2014. For fiscal year 2013, Schneider Downs was engaged by us to audit our annual financial statements. Representatives of Schneider Downs are expected to be present at the Annual Meeting, and will have an opportunity to make a statement if they so desire and will be requiredavailable to respond to appropriate questions.

The Board seeks an indication from shareholders of their approval or disapproval of the anticipated appointment of Schneider Downs as the Company’s independent registered public accounting firm for the election2014 fiscal year. The submission of directors. Approval of amendmentsthis matter for approval by shareholders is not legally required, however, the Board believes that the submission is an opportunity for the shareholders to provide feedback to the Stock Plan and ratificationBoard on an important issue of corporate governance. If the shareholders do not approve the appointment of Tarvaran Askelson &Schneider Downs, the appointment of the Company’s independent registered public accounting firm will be re-evaluated by the Board but will not require the Board to appoint a different accounting firm. If the shareholders approve the appointment of Schneider Downs, the Board in its discretion may select a different independent registered public accounting firm at any time during the year if it determines that such a change would be in the best interest of the Company LLPand its shareholders. Approval of the proposal to ratify the selection of Schneider Downs as the Company'sour independent registered public accountantsaccounting firm requires the affirmative vote of a majority of the votes cast at such meeting. If a stockholder,shares of common stock present in person or represented by proxy abstainsand entitled to be voted on any matter, the stockholder's sharesproposal at the Annual Meeting. Abstentions will have the same effect as votes against the proposal. Broker non-votes will not be considered shares of common stock present and entitled to vote on the proposal and will not have a positive or negative effect on the outcome of this proposal, however, there should be no broker non-votes on this proposal because brokers have the discretion to vote uninstructed common shares on this proposal.

The Board of Directors recommends that the Shareholders vote FOR Proposal 2.

PROPOSAL 3: AMENDMENT TO CERTIFICATE OF INCORPORATION TO INCREASE OUR AUTHORIZED SHARES OF COMMON STOCK

Background

On October 9, 2014, our Board of Directors unanimously approved, subject to shareholder approval, an amendment to our Certificate of Incorporation (“Amendment”). The Board of Directors recommends that the shareholders approve the Amendment to increase from 102,000,000 to 152,000,000 the number of the Company’s authorized shares. The Company currently has authorized 100,000,000 shares of common stock and 2,000,000 shares of preferred stock, 40,228,123 shares of common stock issued and outstanding and 55,323,441 shares of common stock are reserved for issuance upon conversion of notes or exercise of warrants and options as of October 17, 2014. No preferred stock is issued or outstanding as of October 17, 2014. The Board believes that the increase of 50,000,000 in the number of shares of common stock authorized would provide the Company greater flexibility with respect to the Company’s capital structure for such purposes as issuing stock options, additional equity financing, and stock-based acquisitions. The Board of Directors also directed that the Amendment be submitted for approval by the Company’s shareholders as required by Delaware law. A copy of the proposed amendment is included in this proxy statement as Appendix A.

The Board of Directors recommends that the shareholders vote FOR Proposal 3.

Summary

The terms of the additional shares of common stock will be identical to those of the currently outstanding shares of common stock. However, because holders of common stock have no preemptive rights to purchase or subscribe for any unissued stock of the Company, any future issuance of additional shares of common stock will reduce the current shareholders’ percentage ownership interest in the total outstanding shares of common stock. This amendment and the creation of additional shares of authorized common stock will not alter the current number of issued shares. The relative rights and limitations of the shares of common stock will remain unchanged under this amendment.

As of October 17, 2014, a total of 40,228,123 shares of the Company’s currently authorized 100,000,000 shares of common stock are issued and outstanding and 55,323,441 are reserved for issuance upon conversion of notes or exercise of warrants, options and other contractual obligations. The increase in the number of authorized shares of common stock would enable the Company to issue shares from time to time as may be required for proper business purposes, such as issuing stock options, raising additional capital for ongoing operations, business and asset acquisitions, stock splits and dividends, present and future employee benefit programs and other proper corporate purposes.

As of October 17, 2014, in addition to the 40,228,123 shares of common stock outstanding, there are 55,323,441 shares of common stock reserved for issuance upon conversion of notes or exercise of warrants, options and other contractual obligations, and an additional 4,448,436 shares of common stock unreserved and available for issuance. If the amendment to the Certificate of Incorporation is adopted, 54,448,436 shares of common stock would be authorized, unissued and unreserved. The proposed increase in the authorized number of shares of common stock could have a number of effects on the Company’s shareholders depending upon the exact nature and circumstances of any future issuances of authorized but unissued shares. The Securities and Exchange Commission requires the Company to discuss how an increase in authorized shares could be used to make it more difficult to effect a change in control of the Company. The increase could have an anti-takeover effect, in that additional shares could be issued (within the limits imposed by applicable law) in one or more transactions that could make a change in control or takeover of the Company more difficult. For example, additional shares could be issued by the Company so as to dilute the stock ownership or voting rights of persons seeking to obtain control of the Company, even if the persons seeking to obtain control of the Company offer an above-market premium that is favored by a majority of the independent shareholders. Similarly, the issuance of additional shares to certain persons allied with the Company’s management could have the effect of making it more difficult to remove the Company’s current management by diluting the stock ownership or voting rights of persons seeking to cause such removal. The Company does not have any other provisions in its Certificate of Incorporation or Bylaws that have material anti-takeover consequences. Additionally, the Company has no plans or proposals to adopt other provisions, or enter into other arrangements, that may have material anti-takeover consequences. The Board of Directors is not aware of any attempt, or contemplated attempt, to acquire control of the Company, and this proposal is not being presented with the intent that it be utilized as a type of anti-takeover device. While the Company has no present plans for the issuance of additional shares of common stock, it desires to have such shares available for future issuances as the business need may arise.

Vote Required for Approval

Approval of this amendment to the Certificate of Incorporation requires approval by a majority of the outstanding shares of common stock. As a result, any shares not voted on such matter. Thus, an(whether by abstention from voting on a matter hasor otherwise) will have the same legal effect as a vote “against”against the proposal. Brokers will have discretionary authority to vote on this proposal, so broker non-votes will not apply to this proposal.

PROPOSAL 4: APPROVAL OF THE 2014 EQUITY INCENTIVE PLAN, AS AMENDED

Background

The 2014 Equity Incentive Plan, as amended (the “EIP”), was first approved by the Board of Directors on January 10, 2014. The number of shares of the Company’s common stock that may be issued under the EIP was originally 2,500,000 shares, subject to the adjustment for stock dividends, stock splits, recapitalizations and similar corporate events. On October 9, 2014 the Board of Directors approved an amendment to the EIP to increase by 5,000,000 the number of authorized shares of common stock that may be issued under the EIP to 7,500,000. EIP provides that it shall become effective following its adoption by the Board (which occurred on January 10, 2014 and October 9, 2014), subject to its approval by the Company’s shareholders within 12 months after such adoption by the Board of Directors to the extent then required under Section 422 or 424 of the Code or any other applicable law, or deemed necessary or advisable by the Board. This description of the EIP is subject to and qualified by a copy of the EIP (prior to the amendment to increase the shares available to 7,500,000), which is available at www.sec.gov as an exhibit to the Company’s Form 8-K filed with the SEC on January 16, 2014. This filing is also available through the Company’s website www.midwestemissions.com (see “Investors”, “SEC Filings”).

The Board of Directors recommends that the Company’s shareholders vote FOR Proposal 4.

Summary

| · | The purpose of the EIP is to promote the Company’s long-term growth and profitability by enabling the Company to attract, retain and reward key employees and officers and to strengthen the common interests of such employees and the Company’s shareholders by offering key employees and officers equity or equity-based incentives. In addition, the purpose of the EIP is to provide officers, other employees and directors of, and consultants to, the Company and its subsidiaries an incentive (a) to enter into and remain in the service of the Company or its subsidiaries, (b) to enhance the long-term performance of the Company and its subsidiaries, and (c) to acquire a proprietary interest in the success of the Company and its subsidiaries. |

| · | Eligible participants under the EIP include officers, employees of, or consultants to, the Company or any of its subsidiaries, or any person to whom an offer of employment is extended, or any person who is a non-employee director of the Company. |

| · | The EIP will be administered by a committee of the Board comprised of no fewer than two members of the Board. In the absence of a Committee, the Board will administer the EIP. Currently, the EIP is administered by the full Board. |

| · | The Committee (Board) determines who shall receive awards, the type and amount of awards, the consideration, if any, to be paid for awards, the timing of awards and the terms and conditions of awards. |

| · | The types of awards which the Committee (Board) will be able to grant under the EIP include stock options, stock appreciation rights, restricted stock, restricted stock units, performance shares or performance units and stock awards. |

| · | The Committee may grant stock options that (i) qualify as incentive stock options (“ISOs”) under Section 422 of the Internal Revenue Code of 1986, as amended (the “Code”) subject to prior shareholder approval of the EIP, (ii) do not qualify as ISOs, or (iii) both. To qualify as an ISO, an option must meet certain requirements set forth in the Code. |

| · | Stock options and all other equity-based awards will be evidenced by a separate award agreement in the form approved by the Committee (Board). |

| · | Stock options will be exercisable and restricted stock grants will vest at such time or times as the Committee (Board) determines at the time of grant. In general, restricted stock is non-transferable prior to vesting. |

| · | The exercise price of a stock option granted under the EIP may not be less than 100% of the fair market value of the Company’s common stock on the date the stock option is granted, except that with respect to an incentive stock option granted to a 10% stockholder, the exercise price may not be less than 110% of the fair market value of the Company’s common stock on the date of grant. |

| · | The term of each stock option will be fixed by the Committee (Board) and may not exceed ten years from the date the stock option is granted. |

| · | The Committee (Board) may determine and provide in the applicable award agreement that vesting or other terms of an award may be accelerated in the event of change of control (as defined in the EIP) of the Company. |

| · | Non-employee directors will be entitled to receive all types of awards under the EIP, and each non-employee director will be automatically granted a non-qualified stock option to purchase 25,000 shares of common stock on May 1 of each year, if as of such date, such non-employee director will have served on the Board for at least three months, which option shall become exercisable one year from the date of grant and which option shall expire five years from the date of grant. |

| · | In the event of any merger, reorganization, consolidation, recapitalization, share dividend, share split, combination of shares or other change in the Company’s corporate structure affecting the shares, an adjustment or substitution may be made as approved by the Committee (Board). |

| · | The EIP will not be qualified under Section 401(a) of the Code and will not be subject to the provisions of the Employee Retirement Income Security Act of 1974. |

| · | The Board may at any time and from time to time and in any respect, amend the EIP and any award granted under the EIP. The Board may seek the approval of any amendment by the Company’s shareholders to the extent it deems necessary or advisable in its discretion for purposes of compliance with Section 162(m) or Section 422 of the Code, the listing requirements of the applicable exchange or securities market or for any other purpose. |

Federal Tax Consequences

The following summary of the federal income tax consequences applicable to options awarded under the EIP is only a general summary of the applicable provisions of the Code and regulations promulgated thereunder as in effect on the date of this proxy statement. The actual federal, state, local and foreign tax consequences to the participant may vary depending upon his or her particular circumstances.

Incentive Stock Options

Issuance of an ISO does not cause recognition of taxable income to the participant and does not provide a deduction to the Company at the time it is granted or exercised. However, the excess of the fair market value of the shares acquired upon exercise of an ISO over the exercise price is an item of adjustment in computing the alternative minimum taxable income of the participant. If the participant holds the shares received as a result of an exercise of an ISO for at least two years from the date of the grant of the ISO and one year from the date of exercise, then any gain realized on disposition of the shares (generally the amount received in excess of the exercise price) is treated as a long-term capital gain.

If shares acquired on exercise of an ISO are disposed of before expiration of the holding periods described above (i.e., a “Disqualifying Disposition”), the participant will include in income, as compensation for the year of the Disqualifying Disposition, an amount equal to the excess, if any, of the fair market value of the shares on the date of exercise of the ISO over the exercise price (or, if less, the excess of the amount realized upon disposition over the exercise price). The gain or loss on the sale of shares acquired under an ISO will be either a long-term or a short-term capital gain and will depend on whether the participant has held the shares for more than one year. If a participant includes amounts in income upon a Disqualifying Disposition, the Company will be entitled to a deduction, in the year of such a disposition, for the amount includible in the participant’s income as compensation.

The participant’s basis in shares acquired upon exercise of an ISO is equal to the exercise price paid, plus any amount the participant includes in income as a result of a Disqualifying Disposition.

If an ISO is exercised by tendering previously owned shares of common stock, the following generally will apply: a number of new shares equal to the number of previously owned shares of common stock tendered will be considered to have been received in a tax-free exchange; the participant’s basis and holding period (except for the Disqualifying Disposition period) for such number of new shares of common stock will be equal to the basis and holding period of the previously owned common shares exchanged. To the extent that the number of shares of common stock received exceeds the number of shares of common stock surrendered, no taxable income will be realized by the participant at that time; such excess shares of common stock will be considered ISO stock with a zero basis; and the holding period of the participant in such shares of common stock will begin on the date such shares of common stock are transferred to the participant. If the shares of common stock surrendered were acquired as the result of the exercise of an ISO and the surrender takes place within two years from the date the ISO relating to the surrendered shares of common stock was granted, or within one year from the date of such exercise, the surrender will result in a Disqualifying Disposition and the participant will realize ordinary income at that time in the amount of the excess, if any, of the fair market value at the time of exercise of the shares of common stock surrendered over the basis of such shares of common stock. If any of the shares of common stock received are disposed of in a Disqualifying Disposition, the participant will be treated as first disposing of the shares of common stock with a zero basis.

Non-qualified Stock Options

The grant of a non-qualified stock option generally results in no recognition of taxable income to the participant or allowance of a deduction to the Company at the time it is granted. A participant exercising such an option will, at that time, recognize taxable income from compensation equal to the excess of the then market value of the shares over the aggregate exercise price. Subject to the applicable provisions of the Code, the Company will be allowed a deduction for federal income tax purposes in the year of exercise in an amount equal to the taxable income recognized by the participant.

The participant’s basis in shares acquired upon exercise of a non-qualified option is equal to the sum of the exercise price plus the amount includible in his or her income upon exercise. Any gain or loss upon subsequent disposition of the shares of common stock will be a long-term or short-term gain or loss, depending upon the holding period of the shares of common stock.

If a non-qualified option is exercised by tendering previously owned shares of common stock, the following generally will apply: a number of new shares of common stock equal to the number of previously owned shares tendered will be considered to have been received in a tax-free exchange; and the participant’s basis and holding period for such number of new shares of common stock will be equal to the basis and holding period of the previously owned shares of common stock exchanged. The participant will have compensation income equal to the fair market value on the date of exercise of the number of new shares of common stock received in excess of such number of exchanged shares of common stock; the participant’s basis in such excess shares of common stock will be equal to the amount of such compensation income; and the holding period in such shares of common stock will begin on the date of exercise.

Restricted Shares

A participant will not recognize any taxable income upon the grant of restricted stock unless the participant makes a voluntary election to recognize income at grant under Section 83(b) of the Code. Upon the expiration of a restriction period for restricted stock, whether such period lapses due to the satisfaction of certain pre-established performance criteria or due solely to the lapse of time, the participant will recognize compensation income and the Company will be entitled to a deduction equal to the value of the restricted stock that the participant receives.

Vote Required for Approval

The affirmative vote of a majority of the votes cast in person or by proxy by shareholders represented and entitled to vote at the Annual Meeting of Shareholders is required for approval of the EIP. Broker non-votes will not be treated as votes cast and will not have a positive or negative effect on the outcome of the proposal. Abstentions will be treated as votes cast and, consequently, will have the same effect as votes against the proposal.

PROPOSAL 5: SAY-ON-PAY

Pursuant to the requirements of the Dodd-Frank Act, the Company provides its shareholders with the opportunity to cast an advisory non-binding vote to approve the compensation of its Named Executive Officers as disclosed pursuant to the SEC’s compensation disclosure rules (a “say-on-pay proposal”). The Company believes that it is appropriate to seek the views of shareholders on the design and effectiveness of the Company’s executive compensation program.

The Company’s goal for its executive compensation program is to attract, motivate, and retain a talented, entrepreneurial and creative team of executives who will provide leadership for the Company’s success in competitive markets. The Company seeks to accomplish this goal in a way that rewards performance and is aligned with its shareholders’ long-term interests.

The Board recommends that shareholders vote for the following resolution:

“RESOLVED that the compensation paid to the Company’s Named Executive Officers, as disclosed pursuant to Item 402 of Regulation S-K compensation tables and narrative discussion, is hereby APPROVED.” |

Because the vote is advisory, it will not be binding upon the Board. The Board values the opinions of our shareholders and will take into account the outcome of the vote when considering future executive compensation arrangements.

The affirmative vote of a majority of the shares of common stock present or represented by proxy and voting at the annual meeting will constitute approval of this non-binding resolution. Abstentions will have the same effect as votes against the proposal. Broker non-votes will not be considered shares of common stock present and entitled to vote on this proposal and will not have a positive or negative effect on the outcome of the proposal.

The Board of Directors recommends that the shareholders vote FOR Proposal 5.

PROPOSAL 6: SAY ON PAY FREQUENCY

Rules mandated by the Dodd-Frank Act also require the Company to seek a non-binding advisory shareholder vote every six years regarding the frequency (annually, every other year, or every three years) at which the Company will ask its shareholders to provide the advisory vote on executive compensation.

After careful consideration, the Board recommends that future advisory votes on executive compensation occur every year because the Board believes it is important to hear from its shareholders frequently regarding its compensation practices and philosophy.

As an advisory vote this proposal is non-binding. The Board values the opinions of our shareholders and understands that executive compensation is an important matter, even thoughand they will consider the stockholderoutcome of the vote when making future decisions on the frequency of the Company’s executive compensation advisory votes.

Shareholders may interpret such action differently.cast their votes in favor of one year, two years or three years or abstain from voting on the proposal. The choice selected by the greatest number of votes will be deemed the shareholders’ choice on the frequency of the Company’s executive compensation advisory vote. Abstentions and broker non-votes will have no effect on the outcome of this proposal.

PRINCIPAL STOCKHOLDERS AND

The Board of Directors recommends that the shareholders vote for ONE YEAR on Proposal 6.

AUDIT COMMITTEE REPORT

The full Board of Directors act as the Audit Committee. In this report, references to the Committee shall be deemed references to the full Board of Directors. Only one director, Mr. Greenberg, is independent under the Sarbanes-Oxley Act. The Committee’s responsibilities include oversight of the Company’s independent auditors as well as oversight of management’s conduct in the Company’s financial reporting process. The Committee also approves the Company’s retention of independent auditors and pre-approves any audit or non-audit services performed by them. Management is responsible for the Company’s internal controls and the financial reporting process. The independent auditors are responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States) and issuing a report thereon. For fiscal 2013, the Committee has met and discussed with management and the independent auditors the fair and complete presentation of the Company’s financial statements. The Committee has also discussed and reviewed with the independent auditors all communications required by GAAP, including those described in Auditing Standards No. 16, “Communication with Audit Committees”, as adopted by the PCAOB. The Committee has discussed significant accounting policies applied in the financial statements, as well as alternative treatments. Management has represented that the consolidated financial statements have been prepared in accordance with GAAP. The Company’s independent auditors also provided to the Committee the written disclosures and letter required by the applicable requirements of the Public Company Accounting Oversight Board regarding the independent auditor’s communication with the Committee concerning independence. The Committee discussed with the independent auditors their firm’s independence.

Based on the Committee’s discussion with Management and the independent auditors and the report of the independent auditors to the Committee, the Board of Directors included the audited consolidated financial statements in the Company’s Annual Report on Form 10-K for the year ended December 31, 2013 for filing with the Securities and Exchange Commission.

Johnny F. Norris, Jr

Richard A. MacPherson

Jay Rifkin

R. Alan Kelley

Christopher Greenberg

INDEPENDENT AUDITOR FEES

The aggregate audit fees billed to the Company by the Company’s independent auditors, Schneider Downs & Co., Inc., were $62,000 for the year ended December 31, 2013 and $60,000 for the year ended December 31, 2012. Fees billed for professional services rendered in connection with the preparation of our tax returns and other tax compliance services were $11,400 and $10,275 for the years ended December 31, 2013 and December 31, 2012, respectively. There were no audit-related or other fees paid to our independent auditors for the years ended December 31, 2013 and December 31, 2012.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information as of the Record Date, with respect toregarding the beneficial ownership of theour common shares as of September 1, 2014, by: (a) our directors and nominees for election as directors; (b) each other person who is known by us to own beneficially more than 5% of our outstanding common stock by (i) any holdershares; (c) the executive officers named in the Summary Compensation Table; and (d) all of more than five (5%) percent; (ii) each of the namedour executive officers and directors; and (iii) our directors and named executive officers as a group. Except as otherwise indicated, eachThe percentages in the table are calculated on the basis of the stockholders listed below has sole voting and investment power overamount of outstanding securities plus securities deemed outstanding pursuant to Rule 13d-3(d)(1) under the shares beneficially owned.Exchange Act.

| Name of Beneficial Owner (1) | | Common Stock

Beneficially Owned (2) | | Percentage of

Common Stock (2) |

| Jay Rifkin | | 116,867,563 | (3) | | 63.7% |

| William B. Horne | | 2,784,789 | (4) | | 1.7% |

| Alice M. Campbell | | 2,650,000 | (5) | | 1.7% |

| Alan Morelli | | 2,775,000 | (6) | | 1.7% |

| David M. Kaye | | 2,525,000 | (7) | | 1.6% |

| Dennis Pelino | | 36,852,777 | (8) | | 22.9% |

| TWK Holdings Limited | | 12,000,000 | (9) | | 7.6% |

| China Youth Net Technology (Beijing) Co., Ltd. | | 71,020,000 | (10) | | 31.1% |

| All named executive officers and directors as a group (5 persons) | | 127,602,352 | | | 65.7% |

Name of Beneficial Owner | | Number of Shares | | | Percent of

Class (9) | |

| | | | | | | |

Richard A. MacPherson (1) | | | 17,208,295 | | | | 42.2 | % |

| | | | | | | | |

Christopher Greenberg (2) | | | 3,344,000 | | | | 8.3 | % |

| | | | | | | | |

Jay Rifkin (3) | | | 2,691,371 | | | | 6.6 | % |

| | | | | | | | |

R. Alan Kelley (4) | | | 525,000 | | | | 1.3 | % |

| | | | | | | | |

Johnny F. Norris, Jr (5) | | | 225,000 | | | | * | |

| | | | | | | | |

Marcus A. Sylvester (6) | | | 275,000 | | | | * | |

| | | | | | | | |

Richard H Gross (7) | | | 125,000 | | | | * | |

| | | | | | | | |

Alterna Core Capital Assets Fund II, L.P., et al (8) | | | 22,660,600 | | | | 36.2 | % |

| | | | | | | | |

All Executive Officers and Directors as a Group | | | 24,388,166 | | | | 56.6 | % |

(1)* | ExceptLess than one percent of the outstanding shares of common stock of the Company. |

| |

(1) | Includes: (a) 15,919,586 shares and 655,059 warrants, which as otherwise indicated,of September 1, 2014, were owned by 3253517 Nova Scotia Limited of which Mr. MacPherson is the sole managing member; and (b) 506,920 shares and 126,730 warrants owned by Mr. MacPherson personally. Mr. MacPherson’s address of each beneficial owner is c/o China Youth Media, Inc., 4143 Glencoe Avenue, Marina Del Rey, CA 90292.34 Cedarbank Terrace, Halifax Nova Scotia B3P 2T4, Canada. |

(2) | Includes: (a) 2,004,500 shares of common stock directly owned by Arthur Greenberg, Jr. individually, (b) 10,500 shares of common stock directly owned by Greenberg Family Consolidated Limited Partnership, of which Arthur Greenberg, Jr., L.L.P. serves as the general partner. Arthur Greenberg, Jr. is a general partner and the managing partner of Arthur Greenberg, Jr., L.L.P., (c) 1,005,000 shares of common stock and 320,000 options directly owned by Christopher Greenberg individually, and (d) 4,000 shares of common stock directly owned by Arctic Blast of Fargo, Inc., of which Christopher Greenberg and his wife are the sole shareholders. As stated in Mr. Arthur Greenberg and Mr. Christopher Greenberg’s joint Schedule 13G, Amendment No. 1., for purposes of Sections 13(d) and 13(g) of the Securities Exchange Act of 1934, as amended, Arthur Greenberg, Jr. and Christopher Greenberg have shared beneficial ownership as a group of the 3,024,000 shares owned by them as set forth above. Mr. Greenberg’s address is 3590 S. 42nd St., Grand Forks, ND 58201. |

| |

(3) | Includes: (a) 361,585 shares owned by Mojo Music Inc. and 998,128 shares owned by Rebel Holdings, LLC; Mr. Rifkin is the sole managing member of both companies; and (b) 339,130 shares, 357,274 options, and a convertible promissory note with an outstanding balance of $191,054 owned directly by Mr. Rifkin and 148,066 shares owned by The Jay Rifkin 2006 Irrevocable Trust. The note is convertible into units, where each unit consists of: (i) one share of common stock of the Company, par value $0.001 per share, and (ii) a warrant to purchase 0.25 shares of common stock of the Company at an exercise price of $0.75 per share. Mr. Rifkin’s address is 12237 Sunset Parkway, Los Angeles, CA 90064. |

| |

(4) | Represents 525,000 shares of common stock that Mr. Kelley has the right to acquire upon the exercise of a stock option. |

| |

(5) | Represents 225,000 shares of common stock that Mr. Norris has the right to acquire upon the exercise of a stock option. |

| |

(6) | Represents 275,000 shares of common stock that Mr. Sylvester has the right to acquire upon the exercise of a stock option. |

| |

(7) | Represents 125,000 shares of common stock that Mr. Gross has the right to acquire upon the exercise of a stock option. |

(8) | According to the Schedule 13D filed with the SEC by Alterna Core Capital Assets Fund II, L.P. (“Alterna”) and the “Reporting Persons” (as defined in the Schedule 13D) on August 25, 2014, the Reporting Persons have entered into a Joint Filing Agreement, dated August 25, 2014 pursuant to which the Reporting Persons have agreed to file the Schedule 13D jointly in accordance with the provisions of Rule 13d-1(k)(1) of the Securities Exchange Act of 1934, as amended. The amount shown includes: (a) a convertible note for $10,000,000 (the “Note”) maturing July 31, 2018which is convertible into common stock of the Company at $1.00 per share, subject to the following adjustments: (i) an adjustment of the price per share down to $0.75 per share if the Company fails to generate EBITDA (earnings before taxes, interest, depreciation and amortization ) of at least $2,500,000 for calendar year 2015; and (ii) weighted average anti-dilution adjustments to the extent that following the issuance of the Note, the Company issues securities or rights to acquire securities at an effective purchase price below the conversion price for the Note, subject to carve outs for certain exempt issuances by the Company; and (b) a five year warrant to purchase up to 12,500,000 shares of common stock at $1.00 per share, subject to adjustment in a manner similar to the adjustments on the Note. As stated in Schedule 13D the Reporting Persons include Alterna and: |

| (i) | Alterna Capital Partners LLC, a Delaware limited liability company; |

| | |

| (ii) | Alterna General Partner II LLC, a Delaware limited liability company; |

| | |

| (iii) | AC Midwest Entity Corp., a Delaware corporation; |

| | |

| (iv) | AC Midwest Energy LLC, a Delaware limited liability company; and |

| | |

| (v) | Harry V. Toll, James C. Furnivall, Eric M. Press, Roger P. Miller and Earle Goldin. |

According to the Schedule 13D, the Reporting Persons have shared voting and dispositive power of the 22,660,600 shares set forth above. The address for the Reporting Persons is 15 River Road, Suite 230, Wilton CT, 06897.

(9) | Applicable percentage ownership is based on 157,346,67240,006,753 shares of common stock outstanding as of the Record DateSeptember 1, 2014 plus, for each stockholder and any securities that stockholder has the right to acquire within 60 days of the Record DateSeptember 1, 2014 pursuant to options, warrants, conversion privileges or other rights. Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and generally includes voting or investment power with respect to securities. Shares of common stock that a person has the right to acquire beneficial ownership of upon the exercise or conversion of options, convertible stock, warrants or other securities that are currently exercisable or convertible or that will become exercisable or convertible within 60 days of the Record DateSeptember 1, 2014 are deemed to be beneficially owned by the person holding such securities for the purpose of computing the percentage of owners hipownership of such person, but are not treated as outstanding for the purpose of computing the percentage ownership of any other person. |

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth for each of the Company’s last two fiscal years the compensation for the Company’s Principal Executive Officer and each of the Company’s other two most highly compensated officers:

Name, Position | | Year | | | Salary

($) | | | Stock Options

($) (5) | | | All Other Compensation

($) (6) | | | Total

($) | |

Johnny F. Norris, Jr., Chairman (1) | | | 2013 | | | $ | 170,000 | | | | 9,448 | | | | 4,801 | | | $ | 184,249 | |

| | | 2012 | | | $ | 180,000 | | | | - | | | | 10,743 | | | $ | 190,743 | |

| | | | | | | | | | | | | | | | | | | | |

R. Alan Kelley, CEO & President (2) | | | 2013 | | | $ | 280,000 | | | | 9,448 | | | | 9,401 | | | $ | 298,849 | |

| | | 2012 | | | $ | 240,000 | | | | - | | | | 12,695 | | | $ | 252,695 | |

| | | | | | | | | | | | | | | | | | | | |

Richard H. Gross, Vice President & CFO (3) | | | 2013 | | | $ | 150,000 | | | | 9,448 | | | | 5,044 | | | $ | 164,492 | |

| | | 2012 | | | $ | 122,000 | | | | - | | | | 5,411 | | | $ | 127,411 | |

| | | | | | | | | | | | | | | | | | | | |

Marcus A. Sylvester, Vice President (4) | | | 2013 | | | $ | 150,000 | | | | 9,448 | | | | 6,012 | | | $ | 165,460 | |

| | | 2012 | | | $ | 150,000 | | | | - | | | | 7,512 | | | $ | 157,512 | |

|

(3)(1) | Includes (a) 88,354,605 shares heldMr. Norris was appointed Chief Executive Officer in June 2011 and Chairman of the Board in October 2011. In June 2103, he retired from the position of Chief Executive Officer and was an Executive Advisor until April 2014, when he retired from that position. The Company and Johnny F. Norris, Jr have entered into an employment agreement. Pursuant to his employment agreement Mr. Norris agreed to be employed by Rebel Crew Holdings, LLC ("Rebel Holdings") of which Mr. Rifkin is the sole managing member; (b) 2,421,292 shares which are directly held by Mr. Rifkin; (c) 1,666,666 shares issuable upon conversion of a $150,000 principal amount convertible note held by Mojo Music, Inc. of which Mr. Rifkin is the sole managing member, with a conversion price of $0.09 per share; (d) 525,000 shares issuable upon exercise of stock warrants with an exercise price of $0.09 per share; (e) 3,750,000 shares issuable upon exercise of stock options with an exercise price of $0.13 per share, which stock options are fully vested; (f) 150,000 shares issuable upon exercise of stock options with an exercise price of $0.20 per share, which stock options vest annually overCompany as Chief Executive Officer and Chairman for a period of three years, from November 8, 2007;which term may be renewed subject to the approval by the Board. After his retirement, described above, Mr. Norris agreed that he shall serve an employee as an Executive Adviser. During the period of employment, Mr. Norris shall receive an annual base salary equal to $180,000, until his retirement when the annual base salary was adjusted to $120,000. As of December 31, 2013, $130,000 of salary remained unpaid. Under his employment agreement, Mr. Norris shall also be entitled to participate in all corporate 401(k) programs and (g) 20,000,000health benefit plans instituted by the Company and yearly structured bonuses, if any, to be reviewed and approved by the Board. Mr. Norris shall also be entitled to participate in any stock option and incentive plans adopted by the Company. Pursuant to the December 12, 2013 amendment to his employment agreement, because Mr. Norris remained an employee on January 1, 2014, he was issued a 1,500,000 stock unit award on January 1, 2014, which award replaced stock grants in the same denominations that were to be made on January 1, 2014 to Mr. Norris prior to the December 12, 2013 amendment. The stock units will vest and become non-forfeitable upon the earlier of a change in control of the Company or when the Company has a minimum of $3.5 million in working capital and its cash position equals or exceeds $2.5 million after deducting the amount sufficient to cover all federal, state and local taxes required by law to be withheld with respect to the stock units vesting under the aforesaid awards. Such award will be forfeited if the conditions have not been met by January 1, 2017. After the stock units become vested and non-forfeitable, the Company shall distribute to Mr. Norris the number of shares issuable upon exerciseof common stock equal to the number of stock optionsunits that so vested and became non-forfeitable, provided, however, that the Company shall withhold shares of common stock from the stock units in an amount sufficient to cover the withholding tax obligation. In addition, pursuant to the amendment on December 12, 2013, Mr. Norris was issued a five year, fully vested stock option to purchase 25,000 shares of common stock on December 12, 2013 with an exercise price equal to the fair market value of $0.13 per share, whichthe Company’s common stock options vest annually overon that date ($0.50/share). |

(2) | Mr. Kelley was appointed Chief Operating Officer and President in November 2011 and became Chief Executive Officer and a Director in June 2013. The Company and R. Alan Kelley have entered into an employment agreement. Pursuant to his employment agreement Mr. Kelley agreed to be employed by the Company as president and Chief Operating Officer for a period of fourthree years, from May 11, 2009.which term may be renewed subject to the approval by the Board. The agreement was amended to add the duties of Chief Executive Officer as described above. Mr. Rifkin's reported beneficial ownership doesKelley shall receive an annual base salary equal to $280,000. As of December 31, 2013, $140,000 of salary remained unpaid. Under his employment agreement, Mr. Kelley shall also be entitled to participate in all corporate 401(k) programs and health benefit plans instituted by the Company and yearly structured bonuses, if any, to be reviewed and approved by the Board. Mr. Kelley shall also be entitled to participate in any stock option and incentive plans adopted by the Company. Pursuant to the December 12, 2013 amendment to his employment agreement, because Mr. Kelley remained an employee on January 1, 2014, he was issued a 650,000 stock unit award on January 1, 2014, which award replaced stock grants of 500,000 shares that were to be made on January 1, 2014 to Mr. Kelley prior to the December 12, 2013 amendment. The stock units will vest and become non-forfeitable upon the earlier of a change in control of the Company or when the Company has a minimum of $3.5 million in working capital and its cash position equals or exceeds $2.5 million after deducting the amount sufficient to cover all federal, state and local taxes required by law to be withheld with respect to the stock units vesting under the aforesaid awards. Such award will be forfeited if the conditions have not include certainbeen met by January 1, 2017. After the stock units become vested and non-forfeitable, the Company shall distribute to Mr. Kelley the number of shares of common stock issued and issuable for which certain shareholders have granted Mr. Rifkin an irrevocable proxyequal to vote for certain directors. |

|

(4) | Includes (a) 50,000 shares owned by Mr. Horne; (b) 350,000 shares issuable upon exercisethe number of stock optionsunits that so vested and became non-forfeitable, provided, however, that the Company shall withhold shares of common stock from the stock units in an amount sufficient to cover the withholding tax obligation. In addition, pursuant to the December 12, 2013 amendment, Mr. Kelley was issued a five year, fully vested stock option to purchase 25,000 shares of common stock on December 12, 2013 with an exercise price equal to the fair market value of $0.13 per share,the Company’s common stock on that date ($0.50/share). |

(3) | Mr. Gross was appointed Chief Financial Officer and Vice President in October 2011. The Company and Richard H. Gross have entered into an employment agreement. Pursuant to his employment agreement Mr. Gross agreed to be employed by the Company as Chief Financial Officer for a period of three years, which term may be renewed subject to the approval by the Board. Mr. Gross shall receive an annual base salary equal to $150,000. As of December 31, 2013, $37,500 remained unpaid. Under his employment agreement, Mr. Gross shall also be entitled to participate in all corporate 401(k) programs and health benefit plans instituted by the Company and yearly structured bonuses, if any, to be reviewed and approved by the Board. Mr. Gross shall also be entitled to participate in any stock options are fully vested; (c) 150,000option and incentive plans adopted by the Company. Pursuant to the December 12, 2013 amendment to his employment agreement, because Mr. Gross remained an employee on January 1, 2014 he was issued a 100,000 stock unit award on January 1, 2014, which award replaced stock grants of 50,000 shares issuablethat were to be made on January 1, 2014 to Mr. Gross prior to the December 12, 2013 amendment. The stock units will vest and become non-forfeitable upon exercisethe earlier of a change in control of the Company or when the Company has a minimum of $3.5 million in working capital and its cash position equals or exceeds $2.5 million after deducting the amount sufficient to cover all federal, state and local taxes required by law to be withheld with respect to the stock units vesting under the aforesaid award. Such award will be forfeited if the conditions have not been met by January 1, 2017. After the stock units become vested and non-forfeitable, the Company shall distribute to the Mr. Gross the number of shares of common stock equal to the number of stock optionsunits that so vested and became non-forfeitable, provided, however, that the Company shall withhold shares of common stock from the stock units in an amount sufficient to cover the withholding tax obligation. In addition, pursuant to the December 12, 2013 amendment, Mr. Gross was issued a five year, fully vested stock option to purchase 25,000 shares of common stock on December 12, 2013 with an exercise price equal to the fair market value of $0.20 per share whichthe Company’s common stock options vest annually overon that date ($0.50/share). |

| (4) | Mr. Sylvester was appointed Vice President of Sales in August 2011. The Company and Marcus A. Sylvester have entered into an employment agreement. Pursuant to his employment agreement Mr. Sylvester agreed to be employed by the Company as Vice President of Sales for a period of fourthree years, from November 8, 2007; (d) 234,789 shares issuablewhich term may be renewed subject to the approval by the Board. Mr. Sylvester shall receive an annual base salary equal to $150,000, sales commissions of up to 5% and for transactions completed and closed directly in relation to his efforts, and a management fee of 1% on certain ongoing sales. The base salary will be reduced if certain commissions and management fees are earned. As of December 31, 2013, $37,500 of salary remained unpaid. Under his employment agreement, Mr. Sylvester shall also be entitled to participate in all corporate 401(k) programs and health benefit plans instituted by the Company and yearly structured bonuses, if any, to be reviewed and approved by the Board. Mr. Sylvester shall also be entitled to participate in any stock option and incentive plans adopted by the Company. Pursuant to the December 12, 2013 amendment to his employment agreement, because Mr. Sylvester remained an employee on January 1, 2014 he was issued a 250,000 stock unit award on January 1, 2014, which award replaced stock grants in in the same denominations that were to be made on January 1, 2014 to Mr. Sylvester prior to the December 12, 2013 amendment. The stock units will vest and become non-forfeitable upon conversionthe earlier of a $5,000 principal demand promissory notechange in control of the Company or when the Company has a minimum of $3.5 million in working capital and interest accrued totaling approximately $813its cash position equals or exceeds $2.5 million after deducting the amount sufficient to cover all federal, state and various other amounts owedlocal taxes required by law to be withheld with respect to the stock units vesting under the aforesaid award. Such award will be forfeited if the conditions have not been met by January 1, 2017. After the stock units become vested and non-forfeitable, the Company shall distribute to the Mr. Horne totaling approximately $1,231 with a conversion priceSylvester the number of $0.03 per share; and (e) 2,000,000 shares issuable upon exerciseof common stock equal to the number of stock optionsunits that so vested and became non-forfeitable, provided, however, that the Company shall withhold shares of common stock from the stock units in an amount sufficient to cover the withholding tax obligation. In addition, pursuant to the December 12, 2013 amendment, Mr. Sylvester was issued a five year, fully vested stock option to purchase 25,000 shares of common stock on December 12, 2013 with an exercise price equal to the fair market value of $0.13 per share, whichthe Company’s common stock on that date ($0.50/share). |

| |

| (5) | Represents the dollar amount recognized for consolidated financial statement reporting purposes of shares to be issued to the executive officers computed in accordance with FASB ASC Topic 718. For a discussion of valuation assumptions, see Note 13 to our consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2013. There can be no assurance the amounts determined in accordance with FASB ASC Topic 718 will ever be realized. The following table provides information concerning the Stock options vest annually over a period of four years from May 11, 2009.issued to the executive officers: |

Name | | Stock Options(#) | | | FASB ASC

Topic 718

Value | |

Johnny F Norris, Jr. | | | 25,000 | | | $ | 9,448 | |

R. Alan Kelley | | | 25,000 | | | $ | 9,448 | |

Richard H. Gross | | | 25,000 | | | $ | 9,448 | |

Marcus A. Sylvester | | | 25,000 | | | $ | 9,448 | |

| |

(5) | Includes (a) 300,000 shares issuable upon exercise of stock options with an exercise price of $0.13 per share, which stock options are fully vested; (b) 150,000 shares issuable upon exercise of stock options with an exercise price of $0.20 per share which stock options vest annually over a period of four years from November 8, 2007; (c) 200,000 shares issuable upon conversion of amounts owed to Ms. Campbell as fees for services as the Audit Committee Chairwoman totaling $6,000 with a conversion price of $0.03 per share; and (d) 2,000,000 shares issuable upon exercise of stock options with an exercise price of $0.13 per share, which stock options vest annually over a period of four years from May 11, 2009.

|

|

(6) | Includes (a) options to purchase 275,000 shares of common stock with an exercise price of $0.13 per share, which stock optionsThe amounts shown for 2013 in the “All Other Compensation” column are fully vested; (b) 250,000 shares issuable upon exercise of warrants with an exercise price of $0.145 per share and an expiration date of September 15, 2010, (c) options to purchase 250,000 shares of common stock with an exercise price of $0.14 per share, which stock options vest annually over a period of four years from August 8, 2008; and (d) 2,000,000 shares issuable upon exercise of stock options with an exercise price of $0.13 per share, which stock options vest annually over a period of four years from May 11, 2009. |

|

(7) | Includes (a) options to purchase 275,000 shares of common stock with an exercise price of $0.13 per share, which stock options are fully vested; (b) options to purchase 250,000 shares issuable upon exercise of stock options with an exercise price of $0.20 per share which stock options vest annually over a period of four years from November 8, 2007; and (c) 2,000,000 shares issuable upon exercise of stock options with an exercise price of $0.13 per share, which stock options vest annually over a period of four years from May 11, 2009. |

|